Table of Content

Our sliding patio doors and bi-fold doors are the perfect way to maximise light allowance within your Surrey home and give it that ‘wow’ factor it truly deserves. The super-slim sightlines and expansive glazed panels allow you to enjoy uninterrupted views of your exterior surroundings year after year. Our range of aluminium doors are a worthwhile investment that will provide you with excellent aesthetics, design, durability and security. Come down to our Weybridge showroom today to speak to our team, view our products and get free quotes. Visit our Epsom showroom today to get free quotes for any of our products or services.

GHI have transformed my home with their design and colour advice. Installation team were friendly, worked extremely hard, and provided a superb finish; particularly to windows on the tiled elevations. Please pass on my thanks to the team and try to get my second order in before Christmas. This is the second time I have used GHI and will no doubt use them again in the future.

Latest items in Double Glazing & Conservatory Companies

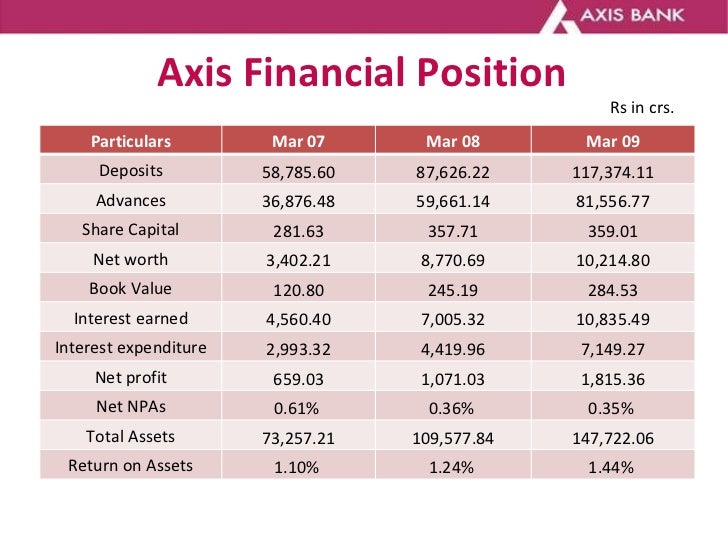

As a General Contractor, we offer services such as Design-Build, Additions, Kitchen Remodeling, Bathroom Remodeling, as well as various exterior remodeling services. According to the latest account statement, there are currently 7 of employees working for GUILD HOME IMPROVEMENTS LIMITED. GUILD HOME IMPROVEMENTS LIMITED number of employees has increased by 40% compared with previous year and now represents a total number of 7. The GUILD HOME IMPROVEMENTS LIMITED-based company said the adjusted EBITDA is now £11,382.00, compared with the previous year of 20753. Ask a question about Guild Home Improvements Our helpful community of likeminded people will be happy to answer any questions that you have.

Great service 10/10 fitters were friendly and left the house spotless, would recommend to anyone. Rory has done a brilliant job.His calm and competent approach was very reassuring as I was quite anxious about the process of removing my old sashes. The new ones look brilliant and my neighbours are already admiring them. Rory also re-hung my blinds which was a great help. I am very pleased with his workmanship and his very pleasant attitude.

“This is the second time I have used GHI and will no...”

Write a review Share feedback about your experience with Wood Home Improvements.Complete a survey Enter the confirmation code from your mailer and publish your review of Wood Home Improvements. Boost the value of your property with the remodeling services of Wood Home Improvements, Inc. in Mocksville, North Carolina. Our services cover residential and light commercial remodeling. Our combination of excellent work, great customer service, and affordable pricing is backed up by our reliability.

We are very happy and satisfied with the way our project turned out. The staff and workers at Classic Home Improvements listened to what we wanted done and made some of their own suggestions. We would use them again for future projects and have already recommended them to others. Our project manager, Royce, and our field technician, Kevin, were extremely knowledgeable in all aspects of the project.

Guild Home Improvements Limited Email Format

Thanks to my neighbour for recomeneding GHI to me. I thought I would take the time to let you know how happy I am with my flush window and folding door installation. An extremely stress free, high quality installation. The guys were very tidy and took lots of care in my home.

We have a friendly, courteous support team here at GHI Windows. They will guide you through the installations process, ensuring it is as hassle free for you as the homeowner. Bringing more light into your home has never been easier, our Atlas roof lanterns will enable you to just that.

If you are commenting on behalf of the company that has been reviewed, please consider upgrading to Official Business Responsefor higher impact replies. We opened our second showroom in Weybridge so that customers local to there do not have to travel all the way to our other Surrey showroom to speak to us in person. We understand that speaking to your local home improvements specialist in person can make a world of difference, so wanted to be closer to our loyal customers. Our flush casement windows will add modern appeal to your Weybridge or Surrey home. Aluminium bi-fold doors are a contemporary option that are sure to enhance any home they are installed into.

Last year, we had GHI install double glazing and replace our guttering - very efficient, clean tidy service and a competitive price to match. Friendly staff who went above and beyond what we had expected and couldnt be more impressed with the service we received. We had a quotation from Jim for sashes to the front of our house and PVC units to the rear, he was extremely helpful and accommodating. They managed to turn around the windows in super quick time and were fitted well, our builders were very impressed and even took their number for future work! You’ll also be able to take a look at the wide array of renovation options that we install across Epsom, including our double glazed windows, external doors and house extensions. You can get a better feel for what would better blend with your property, whether you live in something traditional or modern.

Our team would love the chance to meet you and talk to you about your home improvement needs. Call or email us today to schedule a complimentary estimate.

We show up when we say we'll be there, and all our employees have undergone full background checks. Write a review Share feedback about your experience with Classic Home Improvements.Complete a survey Enter the confirmation code from your mailer and publish your review of Classic Home Improvements. Thank you Classic Home Improvement for the tremendous job on our condo!! Everything from the initial consultation, design approval, product selection to the daily project management and updates went smoothly....

We use unique software to be able to design your windows or doors wherever we are. This innovative system will also provide an accurate, adjusted quote based on your designs. In response to our customer satisfaction surveys, homeowners share lots of comments about construction quality, communication, or any other question asked in the survey. Guildmembers can selectively publish these comments here on their profile page. In order to check the business credit score of GUILD HOME IMPROVEMENTS LIMITED, you can request a credit report. You will view the latest credit limit information, ownership, group structure, court judgements and much more.

Great work from a quality installer who does care. Ranging from the popular casement windows to more grander bow and bay styles, our double glazed windows can fill any purpose in any style of home. Our door options include styles for every budget, including uPVC front doors, composite doors and patio doors. There are even options in stunning aluminium and timber. Superior service from the initial visit which has continued all the way till the end when the items were fitted. Flush upvc windows and Schuco bifold doors installed by Richard and his team with great care and attention to detail.